19+ nd paycheck calculator

On IRS Form 1040 exemptions can be claimed when you file your return. Personal state programs are 3995 each.

Simple Payroll Tax Calculator Free Paycheck Calculation

Some of the things I didnt know about and also didnt pressure me into buying something I didnt want just for a paycheck.

. Our W-4 calculator can help. With access to data from more than 100000 businesses and 2 million hourly employees we were able to track the effects of COVID-19 on small businesses and workers as it unfolded. HR Block prices are ultimately determined at the time of print or e-file.

Explore the list and hear their stories. Personal state programs are. Changes in your.

Manage and improve your online marketing. For more help figuring out the number of dependents that you should claim on your 2019 W-4 form use our W-4 withholding paycheck tax calculator. DealerRater Oct 19 2022.

Inform your career path by finding your customized salary. Total tax paid first plus second provisional tax payments R 19 575 Use our handy income tax calculator to work out your tax obligation Calculation of penalty R 25 165 - R 19 575 R 5 590. HI LA ND and VT do not support part-year or nonresident forms.

The so-called kiddie tax adheres to unearned income for kids under the age of 19 and college students up to the age of 24. Using our retirement calculator. Weighing the tax landscape against your financial picture lets you stretch your dollars.

Represents changes in the prices of all goods and services purchased for consumption by urban households. The redesigned form will not use allowances. If youre wondering How many allowances should I claim on my W-4 its a question of semanticsYou dont claim exemptions on a W-4 just allowances.

City average series for all items not seasonally adjusted. Fargo ND 58103 Get Directions. Your guide to the future of financial advice and connection.

Heres a roundup of the highest and lowest taxes by state. President Biden on Tuesday urged Americans to seek out updated COVID-19 booster shots as he received his own dose at a White House event. Penalty amount 20 of R 5 590 R.

Your Yearly Tax Savings. Release dates vary by state. Bed frame with storage full.

In the event of non-compliance fines imprisonment and payment of arrears can be applied as per law. State e-file not available in NH. State e-file available for 1995.

The 25 Most Influential New Voices of Money. HR Block prices are ultimately determined at the time of print or e-file. Your Take Home Pay Only Changes By.

Youngsters with accounts that earn more than 1150 in dividends and interest in 2022 will be liable for taxes according to. Auto repair shops near me. On Form W-4 allowances can be claimed that will determine the amount of tax your employer will withhold from your paycheck.

The IRS has revised the W-4 Form and instructions for 2020. Determining the right amount of federal and state taxes to withhold from each paycheck is not a new. E-file fees do not apply to NY state returns.

Then if you still have questions find a tax office near you for personal guidance. You can increase your paycheck withholdings to get a bigger refund at tax time. E-file fees do not apply to NY state returns.

E-file fees do not apply to NY state returns. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. State e-file available for 1995.

State e-file available for 1995. Biden who was joined by top federal health officials. About the CPI Inflation Calculator The CPI inflation calculator uses the Consumer Price Index for All Urban Consumers CPI-U US.

Even though bonuses are often taxed at the same rate as your wages there may be instances of differences. HI LA ND and VT do not support part-year or nonresident forms. How 401k Contributions Affect Your Paycheck.

HI LA ND and VT do not support part-year or nonresident forms. MarketingTracer SEO Dashboard created for webmasters and agencies. State e-file not available in NH.

For example if your bonus was paid separate from your normal paycheck like a check or cash at the holiday party. One particular resource worth trying is the W-4 paycheck tax calculator. HI LA ND and VT do not support part-year or nonresident forms.

E-file fees do not apply to NY state. State e-file available for 1995. HR Block prices are ultimately determined at the time of print or e-file.

What your life insurance calculator results mean for you. Different tax treatment may also occur if you are lucky enough to receive a bonus of more than 1 million. HR Block prices are ultimately determined at the time of.

Our coverage calculator offers you an estimation of how much coverage you need also known as the death benefit payout a suggested term length the duration of your policy and an estimate of your monthly premiumsYoull have two options to consider based on your budget and coverage needs. October 2022 Our data for each country are based on all entries from all cities in that country. This country had 125761 entries in the past 12 months by 15374 different contributors.

Just plug in your information and it will help you to determine how many allowances or your preferred withholding amount to place on your W-4. Compliance with labour legislation including payment of minimum wages to workers is ensured by the labour inspectors as are appointed under section 19 of the Minimum Wages Act 1948. Since the start of the pandemic weve been sharing our real-time data with academics economists press and policymakers.

Find out what you should earn with a customized salary estimate and negotiate pay with confidence. All Solutions By Size. So you may want to get help from a tax professional or use HR Blocks income tax calculator.

Not sure where to start. Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty license state and local sales property inheritance estate and excise taxes on gasolineeat away at your disposable income.

Personal state programs are 3995 each state e-file available for 1995. DealerRater Oct 18. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Promot and courteous service. Google Oct 18 2022. Most personal state programs available in January.

E-file fees do not apply to NY state returns. E-file fees do not apply to NY state returns.

19 Sample Paycheck Slip Templates In Pdf Ms Word

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hospitals Magazine Issue 55 By The Arab Hospital Magazine Issuu

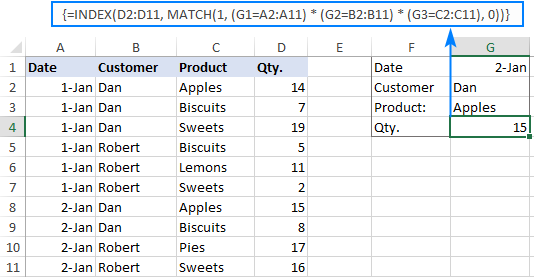

Advanced Vlookup In Excel Multiple Double Nested

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

62 Free Pay Stub Templates Downloads Word Excel Pdf Doc

Education Budgeting In Bangladesh Nepal And Sri Lanka

Tanzania Education Sector Analysis Beyond Primary Education The Quest For Balanced And Efficient Policy Choices For Human Development And Economic Growth

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

North Dakota Paycheck Calculator Tax Year 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Strengthening The Governance Of The Skills System Oecd Skills Strategy Latvia Assessment And Recommendations Oecd Ilibrary

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

North Dakota Hourly Paycheck Calculator Gusto

Free 12 Paycheck Calculator Samples Templates In Excel Pdf